As DORA compliance becomes mandatory, many financial institutions are reassessing their cyber insurance coverage. This guide explains how cyber insurance relates to DORA and what you should consider.

Cyber Insurance in the DORA Context

What DORA Says About Insurance

DORA doesn't mandate cyber insurance, but it:

- Allows entities to use insurance as a risk mitigation tool

- Requires disclosure of insurance coverage in ICT risk assessments

- Expects entities to understand limitations of coverage

- Emphasizes that insurance doesn't replace operational controls

Insurance as Part of Risk Strategy

Cyber insurance should be viewed as:

- Risk Transfer: Financial protection for residual risks

- Not a Substitute: Cannot replace required security controls

- Complementary: Part of comprehensive risk management

- Conditional: Coverage depends on maintaining security measures

How DORA Affects Insurance Requirements

Insurers Demanding DORA Compliance

Insurance companies are now:

- Requiring evidence of DORA compliance for coverage

- Adjusting premiums based on compliance status

- Including DORA-specific questions in applications

- Conducting more thorough security assessments

- Excluding non-compliant entities from coverage

Application Process Changes

Expect insurers to request:

- ICT risk management framework documentation

- Incident history and response capabilities

- Third-party risk management processes

- Evidence of security testing

- Business continuity and disaster recovery plans

- Security certifications and audit reports

Types of Coverage

First-Party Coverage

Protects the insured organization for:

- Business Interruption: Lost income due to cyber incidents

- Data Recovery: Costs to restore systems and data

- Extortion Payments: Ransomware and cyber extortion

- Crisis Management: PR, legal, and notification costs

- Forensic Investigation: Incident analysis and remediation

Third-Party Coverage

Protects against claims from:

- Regulatory Fines: DORA penalties (where insurable)

- Privacy Violations: GDPR and data protection claims

- Network Security Liability: Claims from security failures

- Professional Services: Errors in financial services

Key Policy Considerations

Coverage Limits

Assess appropriate limits based on:

- Potential business interruption losses

- Cost of major incident response

- Regulatory penalty exposure

- Third-party liability exposure

- Ransomware payment scenarios

Exclusions to Watch

Common exclusions include:

- Acts of war and terrorism (increasingly relevant)

- Known vulnerabilities not remediated

- Lack of basic security controls

- Intentional acts by insured

- Betterment costs (improvements beyond restoration)

- Certain regulatory fines

Deductibles and Sub-Limits

Understand:

- Waiting periods for business interruption

- Deductible amounts and when they apply

- Sub-limits on specific coverages

- Aggregate vs. per-occurrence limits

DORA Incident Reporting and Claims

Coordination Requirements

When incidents occur:

- DORA reporting to authorities takes precedence

- Insurer notification timelines must be met

- Coordinate messaging between regulator and insurer

- Maintain privilege for legal communications

Claims Documentation

For successful claims, maintain:

- Detailed incident timeline

- Evidence of compliance with policy conditions

- Quantification of losses

- Response and remediation costs

- Third-party invoices and receipts

Premium Implications of DORA

Factors Affecting Pricing

Insurers consider:

- Compliance Status: Full DORA compliance vs. gaps

- Security Maturity: Quality of controls and testing

- Incident History: Past incidents and response effectiveness

- Industry Sector: Risk profile of financial services provided

- Size and Complexity: Organization scale and interconnections

- Third-Party Dependencies: Cloud and vendor risk management

Reducing Premiums

Demonstrate to insurers:

- Robust DORA compliance program

- Strong security culture and awareness

- Effective incident response capabilities

- Regular testing and validation

- Mature third-party risk management

- Industry certifications and standards

Regulatory Penalties and Insurance

Insurability of DORA Fines

Important considerations:

- Many jurisdictions prohibit insuring regulatory fines

- Coverage for defense costs may be available

- Civil penalties may have different rules than criminal fines

- Policy terms vary by insurer and jurisdiction

- Consult legal advisors on specific situations

Alternative Risk Transfer

Beyond traditional insurance:

- Captive insurance arrangements

- Risk pools with industry peers

- Parametric insurance for specific scenarios

- Self-insurance for certain risks

Selecting the Right Coverage

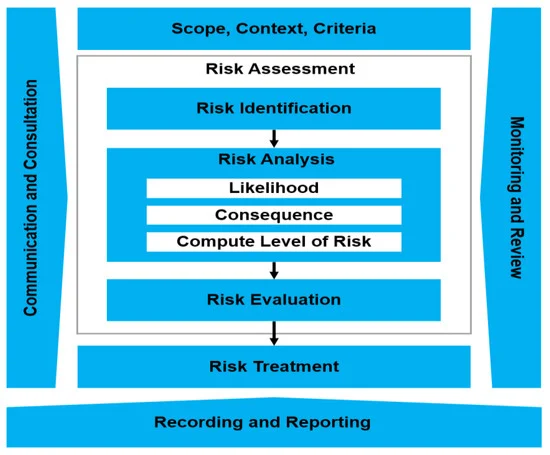

Risk Assessment Process

- Identify Risks: Map DORA risks to insurance coverage

- Quantify Impact: Estimate potential financial losses

- Determine Risk Appetite: What level of loss can you absorb?

- Assess Coverage Options: Compare policies and terms

- Cost-Benefit Analysis: Premium vs. protection value

Policy Comparison Checklist

- Coverage limits and sub-limits

- Deductibles and waiting periods

- Exclusions and limitations

- Incident response services included

- Claims process and support

- Financial stability of insurer

- Experience with financial institutions

- Understanding of DORA requirements

Working with Brokers and Insurers

Choosing a Broker

Select brokers with:

- Experience in financial services sector

- Understanding of DORA requirements

- Access to multiple insurance markets

- Claims advocacy track record

Application Process

Be prepared to provide:

- Comprehensive security questionnaires

- ICT risk management documentation

- Historical incident data

- Third-party risk assessments

- Testing and audit reports

- Business continuity plans

Integration with DORA Framework

Insurance in Risk Register

Document in your ICT risk framework:

- Which risks are covered by insurance

- Coverage limits and gaps

- Policy renewal dates

- Insurance as mitigation vs. residual risk acceptance

Testing Insurance Procedures

Include in resilience testing:

- Incident notification to insurer

- Claims documentation processes

- Coordination with incident response

- Access to insurer-provided resources

Future Trends

Market Evolution

Expect to see:

- Increasing premiums for non-compliant entities

- More detailed compliance verification

- Narrower coverage terms

- Greater emphasis on prevention

- Cyber insurance as competitive differentiator

Innovative Products

- Parametric coverage for specific DORA scenarios

- Bundled compliance and insurance services

- Continuous monitoring-based pricing

- Industry-specific coverage tailored to DORA

Key Takeaways

- Cyber insurance complements but doesn't replace DORA controls

- DORA compliance increasingly required for coverage

- Understand policy terms, exclusions, and limitations

- Document insurance in your ICT risk framework

- Work with experienced brokers and insurers

- Regularly review coverage as risks evolve

- Consider insurance as part of holistic risk strategy